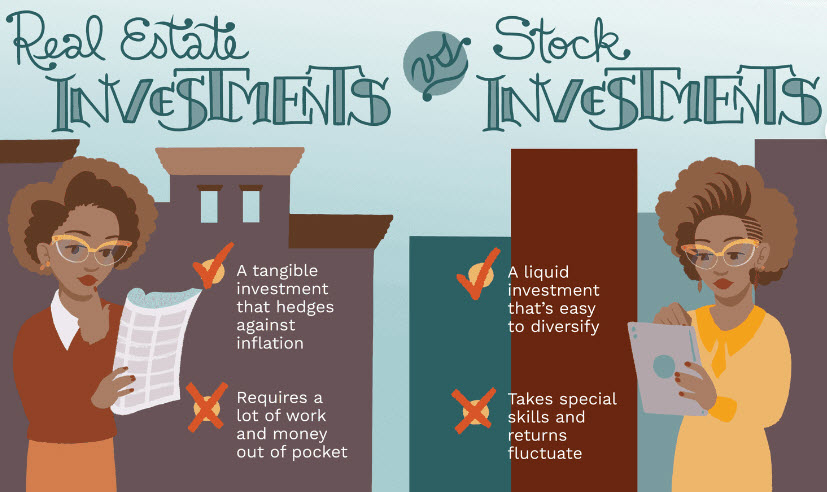

Investing in stocks and real estate are two of the most common paths to wealth accumulation, each presenting unique benefits and risks. Understanding these can help investors make decisions that best fit their personal financial situations rather than conforming to popular opinion or market trends.

Comparison Between Stock and Real Estate Investments

Stock Investments:

- Volatility and Returns: Stock investments, particularly in major indices like the S&P 500, have offered substantial returns, albeit with significant volatility. For instance, the S&P 500 grew fourfold from 1000 points at the end of 2002 to 4000 points by the end of 2022.

- Liquidity and Risk: Stocks offer higher liquidity compared to real estate, which means investors can quickly enter and exit positions. The flip side is higher volatility and potential for large losses, especially if using leverage. For example, if an investor uses leverage to buy stocks and the market dips, they might face margin calls which could necessitate additional funds or force the sale of stocks at low prices.

Real Estate Investments:

- Stability and Growth: Real estate investments, particularly in areas like the Greater Toronto Area (GTA), have similarly seen substantial growth, with average prices increasing from CAD 275,000 in 2002 to CAD 1.16 million in 2022, roughly a 4.2-fold increase.

- Leverage and Safety: Real estate is often purchased with leverage (mortgages), which can enhance returns. A key advantage is that as long as mortgage payments are made, the investment is relatively secure even if property values decline temporarily, avoiding the direct risk of a ‘margin call.’

Leverage Comparisons:

In practical terms, people rarely use cash purchases for homes or leverage at five times the investment for stocks due to the different risk mechanisms involved. Real estate investments typically involve a 20% down payment (five times leverage), and as long as the homeowner keeps up with mortgage payments, the leverage does not “break.” In contrast, similar leverage in stocks is riskier; a 20% drop in stock prices could lead to a margin call, potentially wiping out the investor if they cannot cover the additional funds required.

Investment Returns and Risk Management:

The use of leverage in real estate is generally seen as safer compared to stocks because the continuous payment on mortgages maintains the leverage rather than the volatile adjustments seen in stock investments. This safety net makes real estate an attractive option for families with stable and high incomes.

Evaluating Dividend Insurance Versus Real Estate:

Considering alternative investments such as dividend insurance reveals different risk-return profiles. Dividend insurance, for example, requires substantial upfront investment (premiums) but promises a defined benefit payout structure. Assuming a scenario where a 45-year-old invests heavily in a high cash dividend policy, the returns (cash value) of the policy by the end of the payment period typically represent a majority of the paid premiums, which then appreciatively grow if additional premiums are not required.

Opportunity Costs: Evaluating the opportunity costs of paying insurance premiums versus investing the same in real estate provides a clearer picture of potential returns. If the invested funds in insurance could have been used to purchase real estate, the comparison of returns after 12 years (end of premium payments) would show which investment would have been more profitable considering the current value of real estate grows substantially over long periods.

Cultural and Economic Considerations in Asset Transfer:

In cultural contexts, especially within communities valuing intergenerational wealth transfer, real estate is often preferred for its tangible value and potential to appreciate over time without the tax implications associated with other inheritance forms.

A report by Statistics Canada highlights that homeownership rates among young people (born from 1990 to 1992) vary dramatically based on their parents’ homeownership, indicating that real estate is not only an investment but a tool for familial wealth stability and growth. This pattern underscores the practical and cultural preference for real estate as a means of building and transferring wealth across generations.

In conclusion, both stock and real estate investments have their places in a diversified portfolio. Investors should consider their financial stability, risk tolerance, and long-term goals when choosing between these and other investment opportunities like dividend insurance. The decision should be informed by personal circumstances and market conditions, aiming for strategic growth and security of investment.